Little Known Facts About Insurance Agency.

Little Known Facts About Insurance Agency.

Blog Article

Coverage protection is a type of things which we often ignore till we really want it. It is really the security net that will catch us when lifetime throws us a curveball. No matter whether it's a sudden medical emergency, a car accident, or harm to your property, insurance plan protection ensures that you are not left stranded. But, what precisely will it suggest to acquire insurance policies security? And how do you know if you're genuinely coated? Let's dive into the globe of insurance policies and take a look at its many aspects that will help you realize why it's so necessary.

Top Guidelines Of Insurance For Startups

First, let’s talk about what insurance policy safety genuinely is. It’s basically a contract concerning you and an insurance company that guarantees money guidance in the function of the decline, injury, or harm. In Trade to get a regular monthly or once-a-year quality, the insurance provider agrees to go over sure challenges that you may perhaps encounter. This protection provides satisfaction, knowing that In case the worst transpires, you won’t bear your complete economical load on your own.

First, let’s talk about what insurance policy safety genuinely is. It’s basically a contract concerning you and an insurance company that guarantees money guidance in the function of the decline, injury, or harm. In Trade to get a regular monthly or once-a-year quality, the insurance provider agrees to go over sure challenges that you may perhaps encounter. This protection provides satisfaction, knowing that In case the worst transpires, you won’t bear your complete economical load on your own.Now, you will be contemplating, "I’m healthier, I travel cautiously, and my house is in great condition. Do I really want insurance policy security?" The truth is, we will in no way forecast the long run. Incidents happen, health issues strikes, and organic disasters occur without warning. Insurance coverage defense acts for a safeguard towards these unexpected occasions, supporting you deal with expenditures when factors go wrong. It’s an investment decision within your foreseeable future well-being.

Just about the most prevalent varieties of insurance policy security is well being insurance plan. It handles healthcare fees, from routine checkups to crisis surgical procedures. Without wellbeing insurance policy, even a short clinic stay could go away you with crippling health-related bills. Wellness insurance policy lets you accessibility the care you'll need devoid of stressing about the monetary pressure. It’s a lifeline in moments of vulnerability.

Then, there’s vehicle insurance policies, which is another necessary form of defense. Irrespective of whether you might be driving a brand-new motor vehicle or an more mature model, incidents can take place Anytime. With auto insurance policy, you might be protected in the function of a crash, theft, or damage to your automobile. Moreover, for anyone who is associated with an accident where you're at fault, your coverage can assist deal with The prices for another party’s car repairs and healthcare charges. In a means, auto insurance is like a protect safeguarding you from the implications of the unpredictable road.

Homeowners’ insurance is an additional very important type of defense, particularly if you very own your own private house. This protection safeguards your assets from a number of risks, including hearth, theft, or organic disasters like floods or earthquakes. With no it, you could potentially experience financial destroy if your home had been to become wrecked or severely damaged. Homeowners’ insurance policies don't just covers repairs, but additionally presents legal responsibility safety if anyone is hurt in your property. It is really a comprehensive safety net for your property and anything in it.

Life coverage is 1 area That usually will get overlooked, nonetheless it’s equally as significant. Although it’s not a thing we would like to think about, lifetime insurance ensures that your family and friends are economically secured if something have been to happen to you personally. It provides a payout towards your beneficiaries, helping them address funeral charges, debts, or residing charges. Everyday living coverage is a method of demonstrating your family members that you just treatment, even Once you're long gone.

Another type of insurance plan defense that’s getting ever more common is renters’ insurance policies. If you lease your private home or condominium, your landlord’s insurance may possibly address the creating by itself, but it surely gained’t go over your individual belongings. Renters’ insurance is fairly inexpensive and can safeguard your possessions in the event of theft, fire, or other unexpected occasions. It’s a small expense that can save you from big economical loss.

Though we’re on The subject of insurance policy, Allow’s not ignore incapacity insurance policy. It’s one of many lesser-known types of security, nonetheless it’s incredibly critical. Incapacity insurance delivers money replacement if you become unable to work as a result of disease or harm. It ensures that you don’t shed your livelihood if anything unexpected occurs, allowing for you to definitely concentrate on Restoration without the need of stressing about your finances. For individuals who count on their paycheck for making ends meet up with, incapacity coverage generally is a lifesaver.

Now, Allow’s talk about the value of selecting the ideal insurance policies provider. With numerous choices available, it might be frustrating to select the proper 1 for Get all the details yourself. When deciding on an insurer, you'd like to make certain they offer the protection you will need at a price you may afford to pay for. It’s also important to look at their status, customer care, and the convenience of submitting promises. In spite of everything, you wish an insurance provider that can have your back again when you need it most.

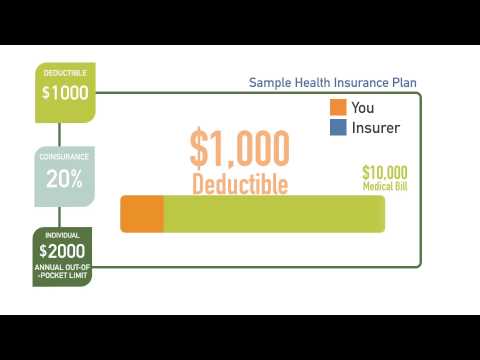

But just possessing insurance protection isn’t adequate. In addition, you will need to be familiar with the terms of your plan. Reading the high-quality print might not be pleasurable, nonetheless it’s critical to know just what exactly’s protected and what isn’t. Be sure to understand the Insurance for Young Adults deductibles, exclusions, and restrictions within your protection. By doing so, you may prevent unpleasant surprises when you should file a claim. Awareness is electrical power In relation to insurance policies.

Insurance Solutions For Nonprofits Things To Know Before You Get This

A further facet to contemplate will be the probable for bundling your insurance coverage policies. Numerous coverage firms give savings if you purchase a number of kinds of insurance coverage via them, for instance dwelling and vehicle coverage. Bundling can help you save income although ensuring that you have extensive defense set up. So, when you’re already purchasing a person kind of insurance plan, it might be really worth Discovering your choices for bundling.The thought of insurance policy security goes beyond own procedures also. Enterprises need insurance coverage far too. Should you possess a business, you probably encounter risks that could affect your company’s fiscal wellness. Small business insurance policy protects you from a range of difficulties, like assets injury, legal liabilities, and staff-linked dangers. For example, common legal responsibility insurance plan might help defend your small business if a buyer is wounded in your premises. Acquiring business enterprise insurance policies gives you the safety to work your business without the need of frequently stressing about what may possibly go wrong.